The standard deduction basically is a flat-dollar, no-questions-asked reduction in your AGI. The amount you qualify for depends on your filing status.

Tax Information

How long should I keep records?

- 3 years – For assessment of tax you owe, this period is generally 3 years from the date you filed the return. Returns filed before the due date are generally treated as filed on the due date.

- No limit – There’s no period of limitations to assess tax when you file a fraudulent return or when you don’t file a return.

- 6 years – If you don’t report income that you should have reported, and it’s more than 25% of the gross income shown on the return, or it’s attributable to foreign financial assets and is more than $5,000, the time to assess tax is 6 years from the date you filed the return.

Business income and expenses:

If you’re in business, there’s not a required method of bookkeeping you must use. However, you must use a method that clearly and accurately reflects your gross income and expenses. The records should substantiate both your income and expenses. If you have employees, you must keep all your employment tax records for at least 4 years after the tax becomes due or is paid, whichever is later.

How long should I keep records?

The period of limitations is the period of time in which you can amend your tax return to claim a credit or refund, or that the IRS can assess additional tax. The below information contains the periods of limitations that apply to income tax returns. Unless otherwise stated, the years refer to the period after the return was filed. Returns filed before the due date are treated as filed on the due date.

Note: Keep copies of your filed tax returns. They help in preparing future tax returns and making computations if you file an amended return.

- You owe additional tax and situations (2), (3), and (4), below, do not apply to you; keep records for 3 years.

- You do not report income that you should report, and it is more than 25% of the gross income shown on your return; keep records for 6 years.

- You file a fraudulent return; keep records indefinitely.

- You do not file a return; keep records indefinitely.

- You file a claim for credit or refund* after you file your return; keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later.

- You file a claim for a loss from worthless securities or bad debt deduction; keep records for 7 years.

- Keep all employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later.

The following questions should be applied to each record as you decide whether to keep a document or throw it away.

What should I do with my records for nontax purposes?

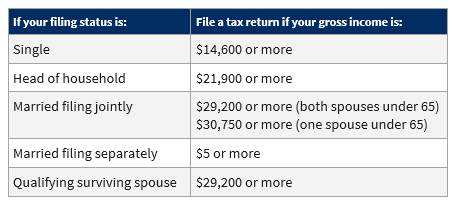

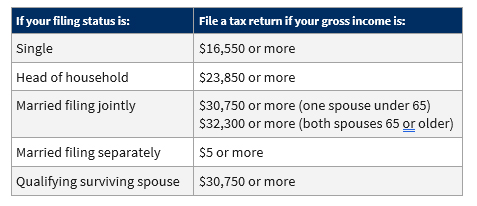

Income amount that requires you to file.

If you were under 65 at the end of 2024

You may want to file a return even if you made less to get a refund of taxes your employer withheld from your pay.

If you were 65 or older at the end of 2024

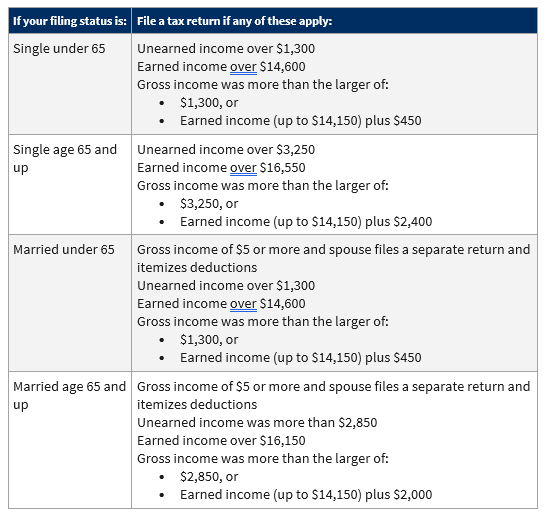

Dependents

Use this table if your parent or someone else can claim you as a dependent in 2024:

Earned income: Salaries, wages, tips, professional fees, and taxable scholarship and fellowship grants.

Unearned income: Taxable interest, ordinary dividends, and capital gain distributions, unemployment compensation, taxable Social Security benefits, pensions, annuities and distributions of unearned income from a trust.

Gross income: Earned plus unearned income.

You can also answer questions to find out if you need to file.

IF YOU HAVE DOCUMENTS THAT YOU ARE NOT SURE ABOUT PLEASE BRING WITH YOU AT TIME OF YOUR APPOINTMENT FOR MY REVIEW.

Period of limitation for refund claims:

- The later of 3 years or 2 years after tax was paid – For filing a claim for credit or refund, the period to make the claim is 3 years from the date you filed the original return or 2 years from the date the tax was paid, whichever is later. If no return was filed, the period to file a claim is 2 years from the date the tax was paid.

- 7 years – For filing a claim for an overpayment resulting from a bad debt deduction or a loss from worthless securities, the time to make the claim is 7 years from when the return was due.

The Standard Deduction

Filing Status | 2023 Tax Year | 2024 Tax Year |

|---|---|---|

| Single | $13,850 | $14,600 |

| Married filing jointly or Qualifying surviving spouse | $27,700 | $29,200 |

| Married Filing Separately | $13,850 | $14,600 |

| Head of Household | $20,800 | $21,900 |

Earned Income and AGI Limits

Earned income and adjusted gross income (AGI) must each be less than:

If Filing for 2023 | Qualifying Children Claimed | |||

|---|---|---|---|---|

| Zero | One | Two | Three or more | |

| Single, Head of Household, Married filing separately or Widowed | 17,640 | $46,560 | $52,918 | $56,838 |

| Married Filing Jointly | $24,210 | $53,120 | $59,478 | $63,398 |

If Filing for 2024 | Qualifying Children Claimed | |||

|---|---|---|---|---|

| Zero | One | Two | Three or more | |

| Single, Head of Household, Married filing separately or Widowed | $18,591 | $49,084 | $55,768 | $59,899 |

| Married Filing Jointly | $25,511 | $56,004 | $62,688 | $66,819 |

Maximum Credit Amounts

Qualifying Children Claimed | 2023 Tax Year | 2024 Tax Year |

|---|---|---|

| Zero | $600 | $632 |

| One | $3,995 | $4,213 |

| Two | $6,604 | $6,960 |

| Three or more | $7,430 | $7,830 |

Investment Income Limit

Filing for 2023:

Investment income must be $11,000 or less for the year.

Filing for 2024:

Investment income must be $11,600 or less for the year.

Reference 2025

Beginning on Jan. 1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 70 cents per mile driven for business use, and

- 21 cents per mile driven for medical or moving purposes, and

- 14 cents per mile driven in service of charitable organizations.

Reference 2024

Beginning on Jan. 1, 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 67 cents per mile driven for business use, and

- 21 cents per mile driven for medical or moving purposes, and

- 14 cents per mile driven in service of charitable organizations.

Tax Withholding

The Tax Cuts and Jobs Act changed the way tax is calculated. The IRS encourages taxpayers to perform a quick “paycheck checkup” by using the Withholding Calculator to check if they have the right amount of withholding for their personal situation.